Geopolitical Shocks: Reshaping the Global Aluminum Supply Chain - Abstract

1. Introduction

In the global trade landscape, geopolitical events can severely disrupt industries, and the aluminum industry is no exception. The aluminum supply chain, spanning multiple countries, is highly sensitive to geopolitical tensions. The Russia - Ukraine conflict, with the EU potentially banning Russian aluminum imports, has brought significant uncertainty to the global aluminum market. This article will analyze how this situation impacts the aluminum supply pattern,supply chain adjustments, the search for alternative sources, and long - term aluminum prices.

2. Russia's Position and the Threat of a Ban

2.1 Russia as a Major Producer

Russia is a dominant force in the global aluminum market. In 2023, it produced about 3.7 million metric tons of primary aluminum, accounting for around 6% of the world's total production. For instance, companies like United Company Rusal, one of the world's largest aluminum producers, operate from bauxite mines in Russia to production facilities across the globe. They export high - quality aluminum profiles and other products to over 100 countries, making Russia a crucial supplier globally.

2.2 Consequences of an EU Ban

An EU ban on Russian aluminum would hit hard. The EU imports nearly 30% of Russia's aluminum exports. Losing this market would mean significant revenue losses for Russian producers. For example, if the ban is implemented, Russian aluminum plants may have to cut production, leading to layoffs and financial strain on the companies. For the EU, finding alternative, reliable, and cost - effective sources would be a major challenge. European aluminum - using industries, such as automotive and construction, rely on the stable supply of Russian aluminum for their cost - effective production.

2.3 Disruption to the Supply Pattern

If the ban occurs, it would disrupt the global aluminum supply pattern,creating a supply gap of around 2% globally. In 2024, as the possibility of the ban loomed, the London Metal Exchange saw increased price volatility in aluminum futures. This would affect not only the EU but also regions relying on EU's aluminum trade. For example, some African and Asian countries that import aluminum - based products from the EU may face shortages or higher costs.

3. Supply Chain Adjustments

3.1 Rerouting of Trade

The conflict forces a change in aluminum trade routes. Traditional routes through the Black Sea and Ukraine are now risky. Rerouting via the Arctic increases transportation costs by 20 - 30% and doubles transit times. Insurance premiums also soar. In 2022, when the conflict first escalated, some shipping companies had to quickly find alternative routes for transporting aluminum products, leading to higher costs and longer delivery times for customers.

3.2 Diversifying Supply Sources

Countries and companies are seeking alternative aluminum suppliers. European firms look to North America, South America, and the Middle East. The US could increase production with new investments, and countries like Brazil aim to expand their capacities. Some also boost domestic production with government support. For example, in 2024, a major European automotive manufacturer signed a long - term contract with a Brazilian aluminum producer to secure its aluminum supply.

3.3 Impact on Production and Distribution

Supply chain adjustments pose challenges to aluminum production and distribution. Producers in new regions face labor shortages and infrastructure issues. New logistics and distribution networks require significant investment to ensure smooth product flow. When some Asian countries started to increase their aluminum production to meet the potential shortfall, they faced difficulties in hiring experienced workers and building efficient transportation systems to move the products.

4. Search for Alternative Supply Sources

4.1 Emerging Producers

Regions like North America, South America, and the Middle East have the potential to increase aluminum production. Canada and the US in North America, Brazil in South America, and the UAE in the Middle East are making efforts to expand their roles in the global aluminum market. For example, the UAE has plans to increase its aluminum production capacity by 20% in the next five years.

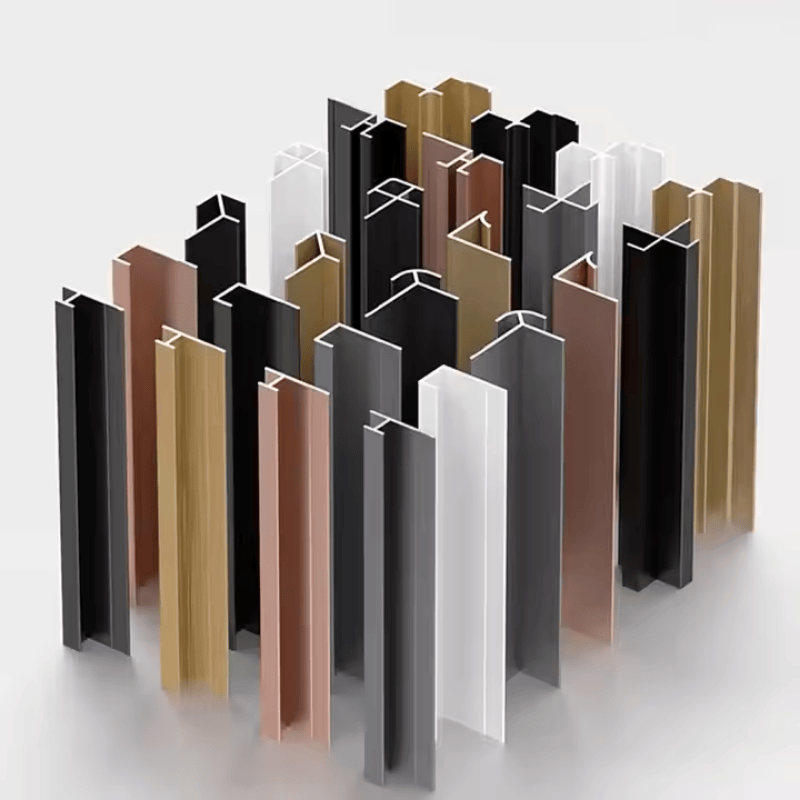

4.2 The Rise of Recycled Aluminum

The geopolitical situation has increased the focus on recycled aluminum. Recycling requires much less energy than primary production. Its use in aluminum profile production is rising, and many invest in improving recycling technologies and capacity. In some European countries, the use of recycled aluminum in construction projects has increased by 15% in the past two years due to the push for sustainability and supply chain security.

4.3 Cooperation and Partnerships

Countries and companies collaborate to secure aluminum supplies. New trade agreements are negotiated, and joint ventures in production and exploration are formed to share risks and costs. In 2024, two major aluminum companies from different countries formed a joint venture to develop new aluminum mines in Africa, aiming to ensure a stable supply of raw materials.

5. Long - term Impact on Aluminum Prices

5.1 Initial Price Volatility

Short - term, the conflict and potential ban caused aluminum prices on the London Metal Exchange to spike by 15%. However, prices have since been influenced by alternative producers' responses and demand changes. In 2022, when the Russia - Ukraine conflict first started, aluminum prices jumped as market participants anticipated supply disruptions.

Determinants of Long - term Prices

Long - term aluminum prices depend on alternative producers' ability to fill the supply gap, the growth of recycled aluminum, geopolitical developments, and global economic conditions. If new producers in North America and South America can quickly scale up production, it could stabilize prices.

5.2 Market Forecasts

Analysts have different outlooks. Some predict high prices due to supply shortages, while others expect stabilization if new sources are developed and the conflict resolves. For instance, Goldman Sachs forecasts that aluminum prices could remain elevated until 2026 if the EU ban on Russian aluminum is implemented and alternative sources fail to meet the demand promptly. Conversely, JP Morgan analysts suggest that with successful development of new supply chains and increased recycling rates, prices could return to pre - conflict levels by 2025. These varying predictions underscore the complexity of the market and the significance of geopolitical factors in shaping the future of aluminum prices.

6. Conclusion

Geopolitical events, especially the Russia - Ukraine conflict, significantly impact the global aluminum supply chain. The potential EU ban on Russian aluminum disrupts the supply pattern and forces industry - wide adjustments. Despite challenges, opportunities exist in new supply sources and recycled aluminum. The aluminum industry must adapt to geopolitical uncertainties to ensure stable product supply.

En

En

Location:

Location: