2025 Aluminum Price Forecast: Insights and Trends

Aluminum Industry Overview

Aluminum is crucial in the global economy, used widely in construction, automotive, and aerospace.

Its unique properties like light - weight and corrosion resistance make it indispensable.

Understanding price - influencing factors is vital due to growing demand.

Key Factors Influencing Aluminum Prices

Supply Dynamics: Bauxite extraction is affected by geographical concentration, environmental regulations. Alumina refining faces energy cost and upgrade issues. Electrolysis depends on electricity availability and cost.

Demand Trends: Construction, automotive (especially EVs), electronics, and packaging industries drive aluminum demand.

2025 Price Forecast Analysis

Different institutions have varied forecasts.

Supply is influenced by mining regs, energy costs, and geopolitics. Demand depends on economic recovery, EV growth, macro - policies, and trade policies. Exogenous shocks also matter.

Role of Aluminum Profile, Extrusion Profiles, and Aluminium Extrusion

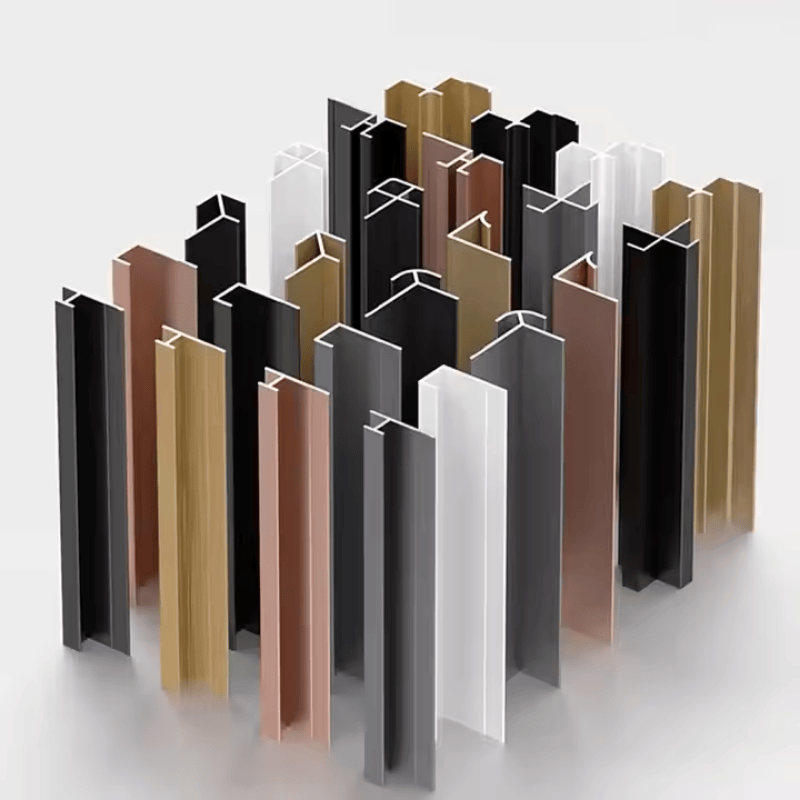

Aluminum Profile Applications: Used in industrial machinery, electronics, and construction for its functionality and aesthetics.

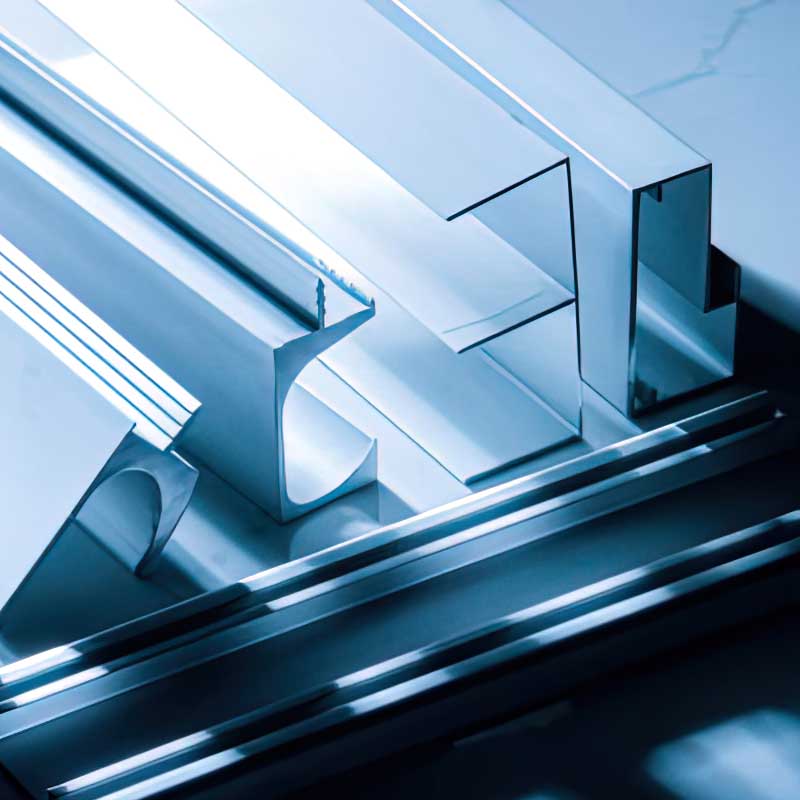

Extrusion Technology: Direct and indirect extrusion methods exist. Tech advancements like CAD/CAM and automation improve production.

Future Outlook and Challenges

Growth expected in renewable energy and 5G.

Challenges include rising costs, strict environmental regs, competition, and geopolitical tensions.

Conclusion

Multiple factors shape 2025 aluminum prices.

Challenges coexist with promising demand.

Pose a question about aluminum recycling and offer technical assistance.

Aluminum Industry Overview

The aluminum industry stands as a cornerstone of the global economy, permeating every aspect of our modern lives. Aluminum, renowned for its unique combination of light weight, high strength, and excellent corrosion resistance, has become an indispensable material in a myriad of applications. From the soaring heights of skyscrapers and the sleek frames of automobiles to the intricate components of electronic devices and the efficient blades of wind turbines, aluminum plays a pivotal role.

In the construction sector, aluminum profiles are widely used for window frames, curtain walls, and roofing systems, providing architects and builders with the freedom to design structures that are not only aesthetically pleasing but also energy-efficient and durable. The automotive industry has increasingly turned to aluminum to reduce vehicle weight, enhance fuel efficiency, and lower emissions, with aluminum extrusion techniques enabling the production of complex and lightweight parts. In the aerospace realm, aluminum alloys are the go-to choice for aircraft fuselages, wings, and engine components, where strength-to-weight ratio is of paramount importance.

This extensive use of aluminum across diverse industries makes it a barometer of economic activity. As global development accelerates, the demand for aluminum continues to surge, making it crucial to understand the factors that influence its price dynamics. In the following sections, we will delve into the intricate web of elements that shape the aluminum market, with a particular focus on the prospects for 2025. Whether you're an industry insider, an investor, or simply curious about the forces driving this essential metal, join us on this exploration of the aluminum price forecast for 2025.

Key Factors Influencing Aluminum Prices

Supply Dynamics

The supply of aluminum is a complex web that begins with the extraction of bauxite, the primary ore of aluminum. Bauxite deposits are geographically concentrated, with major reserves found in countries like Australia, Guinea, and Brazil. Any disruptions in these regions, whether due to political instability, labor strikes, or natural disasters, can send shockwaves through the global aluminum supply chain. For instance, Guinea, which supplies a significant portion of the world's bauxite, has experienced political unrest in recent years. In 2021, political tensions led to concerns about potential disruptions in bauxite exports, causing aluminum prices to spike in anticipation of supply shortages.

Mining bauxite is not without its challenges. Environmental regulations have tightened globally, making it more difficult and costly to extract the ore. In many regions, mining companies are required to implement extensive reclamation and remediation measures to minimize the environmental impact. This has led to longer permitting processes and increased capital expenditures for new mining projects.

Once mined, bauxite is refined into alumina, a key intermediate in aluminum production. The alumina refining process is energy-intensive and requires significant capital investment. China is the world's largest producer of alumina, accounting for a substantial portion of global capacity. However, the industry is facing challenges such as rising energy costs and the need to upgrade aging refineries to meet environmental standards. In 2024, some Chinese alumina refineries had to cut production due to a combination of factors, including high coal prices and stricter emissions controls. This led to a tightening of the alumina market and contributed to upward pressure on aluminum prices.

The final step in the production process is electrolysis, where alumina is converted into aluminum using large amounts of electricity. The availability and cost of electricity are critical determinants of aluminum production costs. In regions with abundant and cheap hydropower, such as Canada and Norway, aluminum smelters have a competitive advantage. Conversely, in areas where electricity prices are high or supply is unreliable, aluminum production can be unviable. In Europe, for example, rising electricity prices in recent years have forced some smelters to reduce capacity or even shut down operations.

Demand Trends

The construction industry has long been a major consumer of aluminum profiles and extrusion products. Aluminum's corrosion resistance, light weight, and ease of fabrication make it an ideal material for window frames, curtain walls, and roofing systems. In the wake of the global push for energy-efficient buildings, aluminum's thermal conductivity properties have also come to the fore. High-performance aluminum window frames can significantly reduce heat transfer, contributing to lower energy consumption in buildings. In emerging economies, rapid urbanization is fueling a construction boom, driving up demand for aluminum in building applications. In India, for example, the government's ambitious housing initiatives have led to increased demand for aluminum products in residential construction.

The automotive sector is undergoing a profound transformation, with aluminum playing a central role. As automakers strive to meet stringent fuel efficiency and emissions standards, they are turning to aluminum to reduce vehicle weight. Aluminum extrusion techniques enable the production of complex, lightweight components, such as engine blocks, chassis parts, and body panels. Electric vehicles (EVs) are a particular growth driver for aluminum demand. EV batteries are heavy, and using aluminum in the vehicle's structure helps offset this weight, improving range and performance. According to industry estimates, an average EV contains significantly more aluminum than a traditional internal combustion engine vehicle. As the global EV market accelerates, the demand for aluminum in automotive applications is set to soar. In China, the world's largest EV market, government incentives and consumer demand for cleaner transportation are propelling the growth of the aluminum-intensive EV industry.

The electronics and packaging industries also rely heavily on aluminum. In electronics, aluminum is used for heat sinks, circuit boards, and casings due to its excellent heat dissipation properties. The miniaturization trend in electronics has led to increased demand for precision aluminum extrusions. In the packaging sector, aluminum cans are the preferred choice for beverages and food products due to their recyclability and ability to preserve freshness. The growing consumer preference for sustainable packaging options is further boosting the demand for aluminum in this area. In North America and Europe, the shift away from single-use plastics has led to a significant increase in the use of aluminum cans for beverages.

2025 Price Forecast Analysis

When it comes to predicting aluminum prices in 2025, the task is fraught with uncertainties, yet several institutions and experts have ventured their forecasts based on available data and trends. Goldman Sachs, for instance, initially projected the aluminum price in 2025 to be around 2,540 per tonne, citing factors such as anticipated changes in supply dynamics and a potential moderation in demand growth. Later, in October 2024, Goldman Sachs again revised its forecast, this time upward to $2,700 per tonne, reflecting evolving market conditions and expectations of tighter supply.

Bank of America, on the other hand, took a more cautious stance. Their analysts predicted a 6% decline in aluminum prices by 2025, estimating an average price of around $2,813 per tonne. This projection was underpinned by concerns over potential trade disputes that could disrupt global supply chains and dampen demand, especially in key industries like automotive and construction.

These divergent forecasts highlight the complexity of the factors at play. On the supply side, the continued evolution of mining regulations, energy costs, and geopolitical risks in major bauxite and alumina-producing regions will be crucial. In Guinea, any political instability could curtail bauxite exports, tightening the global supply. In China, the push for carbon neutrality might lead to further restrictions on energy-intensive alumina and aluminum production, potentially reducing supply.

From a demand perspective, the pace of global economic recovery will be a decisive factor. If the construction sector in emerging economies like India and Southeast Asian countries continues to expand robustly, driven by urbanization and infrastructure development, it could provide a significant boost to aluminum demand. Similarly, the growth trajectory of the electric vehicle market will be closely watched. As governments worldwide intensify their efforts to phase out internal combustion engine vehicles and promote EV adoption, the demand for aluminum in automotive applications could skyrocket. In Europe, for example, stringent emissions targets and generous incentives for EV purchases are likely to drive up aluminum consumption.

Macroeconomic policies also loom large. Central bank policies regarding interest rates and monetary stimulus can influence investment in infrastructure and manufacturing, which in turn impacts aluminum demand. In the United States, if infrastructure spending plans are fully implemented, it could create a surge in demand for aluminum in construction projects.

Trade policies are another wildcard. Tariffs and trade restrictions can disrupt the flow of aluminum and its products across borders. The ongoing trade tensions between major economies, such as the United States and China, have had a significant impact on aluminum trade flows in recent years. Any escalation or de-escalation of these tensions could have far-reaching consequences for the global aluminum market.

Moreover, unforeseen events, such as natural disasters or global health crises, can send shockwaves through the industry. The COVID-19 pandemic in 2020 and 2021 led to widespread disruptions in production, supply chains, and demand, causing extreme volatility in aluminum prices. While the industry has since recovered, the memory of such disruptions serves as a reminder of the vulnerability of the global aluminum market to exogenous shocks.

In conclusion, predicting the aluminum price in 2025 is a challenging endeavor, with multiple variables interacting in complex ways. While institutions have offered their forecasts, the actual price will ultimately depend on how these factors unfold in the coming years. Industry participants, investors, and consumers alike should closely monitor these developments to make informed decisions.

Role of Aluminum Profile, Extrusion Profiles, and Aluminium Extrusion

Aluminum Profile Applications

Aluminum profiles are the building blocks of modern manufacturing and construction, serving a vast array of industries. In the industrial sector, aluminum profiles find extensive use in machinery, robotics, and automation. For instance, in the automotive assembly line, aluminum profiles are employed to construct the framework for conveyor belts and robotic workstations. Their lightweight nature allows for easy installation and reconfiguration, enhancing the flexibility of production lines. In electronics manufacturing, precision aluminum profiles are used for heat sinks and enclosures. The excellent thermal conductivity of aluminum helps dissipate heat generated by electronic components, ensuring optimal performance and longevity.

In the construction realm, aluminum profiles have revolutionized building design. Architectural curtain walls, made predominantly of aluminum profiles, offer a sleek and modern aesthetic while providing excellent insulation and weather resistance. These curtain walls allow natural light to flood interior spaces, reducing the need for artificial lighting and contributing to energy efficiency. Aluminum window and door frames are another staple in construction. They are not only durable and corrosion-resistant but also offer superior thermal performance compared to traditional materials. In cold climates, thermally broken aluminum window frames minimize heat loss, while in hot and humid regions, they prevent the ingress of moisture and heat.

Extrusion Profiles and Aluminium Extrusion Technology

The extrusion process is at the heart of aluminum profile production. It involves forcing a heated aluminum billet through a die to create a desired cross-sectional shape. This process takes advantage of aluminum's plasticity at elevated temperatures, allowing it to be molded into intricate and precise forms. There are two primary methods of extrusion: direct extrusion and indirect extrusion. In direct extrusion, the billet is placed in a container and pushed through the die using a ram. This is the most common and straightforward method, suitable for a wide range of profiles. However, it can result in some friction between the billet and the container walls, leading to inefficiencies. Indirect extrusion, on the other hand, involves placing the die on a hollow ram, and the billet is held stationary while the ram moves inward, forcing the aluminum through the die. This method reduces friction and can produce profiles with better surface finishes and tighter tolerances, albeit at a higher cost due to more complex equipment requirements.

Advancements in extrusion technology have continuously improved the quality and efficiency of aluminum profile production. Computer-aided design (CAD) and computer-aided manufacturing (CAM) systems now enable precise die design and optimization. This ensures that the extrusion process can produce complex shapes with minimal material waste. Additionally, new alloy formulations have been developed to enhance the mechanical properties of extruded aluminum profiles. For example, some alloys offer increased strength-to-weight ratios, making them ideal for aerospace and automotive applications. The ability to tailor the alloy composition to specific application requirements has further expanded the versatility of aluminum extrusion technology.

Moreover, automation has transformed the extrusion process. Automated loading and unloading systems, as well as real-time process monitoring, have reduced labor requirements and improved production consistency. These technological strides have not only lowered production costs but also enhanced the overall quality and reliability of aluminum extrusion products, strengthening the position of aluminum in the global materials market.

Future Outlook and Challenges

Looking ahead to 2025 and beyond, the aluminum industry is poised for continued growth in several key areas. The renewable energy sector, especially wind and solar power, is expected to drive significant aluminum demand. Wind turbine blades and solar panel frames rely heavily on aluminum's lightweight and corrosion-resistant properties. As the world accelerates its transition to clean energy, the aluminum requirements for these applications will soar. In addition, the expansion of 5G infrastructure will create new opportunities. Aluminum is used in the construction of 5G base stations and the heat dissipation components of electronic equipment, given its excellent thermal conductivity.

However, the industry also faces a multitude of challenges. On the cost front, the rising prices of raw materials, such as bauxite and energy, pose a significant threat to profitability. The need to comply with increasingly stringent environmental regulations also adds to the cost burden, as companies must invest in pollution control and waste management technologies. Technological innovation is crucial but requires substantial capital investment. Developing new alloy formulations, improving extrusion processes, and enhancing recycling technologies are essential for the industry's long-term competitiveness.

Market competition is another area of concern. As the global aluminum market becomes more saturated, companies must differentiate themselves through product quality, service, and innovation. Chinese aluminum producers, in particular, face increasing pressure to upgrade their technology and move up the value chain, as they compete with international rivals. Geopolitical tensions and trade disputes can disrupt supply chains and impact market access, adding an element of uncertainty to the industry's future.

In conclusion, the aluminum industry in 2025 will be a complex landscape of opportunities and challenges. While the growth prospects in sectors like renewable energy and electronics are promising, companies must navigate a host of issues related to cost, technology, and competition. Whether you're an industry veteran or a newcomer, staying informed and adaptable will be key to success in this dynamic market. If you have any questions about aluminum profiles, extrusion technologies, or the latest market trends, don't hesitate to reach out to us. Our team of experts is always ready to provide you with the insights and solutions you need.

As we wrap up this exploration of the aluminum market, one lingering question remains: How will emerging technologies, such as 3D printing and advanced composites, impact the future demand and price of aluminum? Will they complement aluminum's existing applications or pose a threat to its dominance in certain sectors? Only time will tell, but it's a question worth pondering as we look ahead to the next chapter in the aluminum industry's evolution.

Conclusion

IIn conclusion, multiple factors interplay to determine aluminum prices in 2025. Supply, influenced by ore sources, production tech, and policies, meets the demands from construction, transport, and electronics sectors. Technological progress in aluminum extrusion has optimized profiles' quality and cost, fueling wider application.

Looking forward, while the overall demand for aluminum is promising, challenges such as rising costs cannot be ignored. A pressing question remains: how can the aluminum recycling system be refined to boost efficiency and sustainability? For any technical inquiries regarding aluminum, don't hesitate to reach out to us.

En

En

Location:

Location: