ASEAN's Aluminum Market Expansion in 2025

OUTLINRE

Introduction

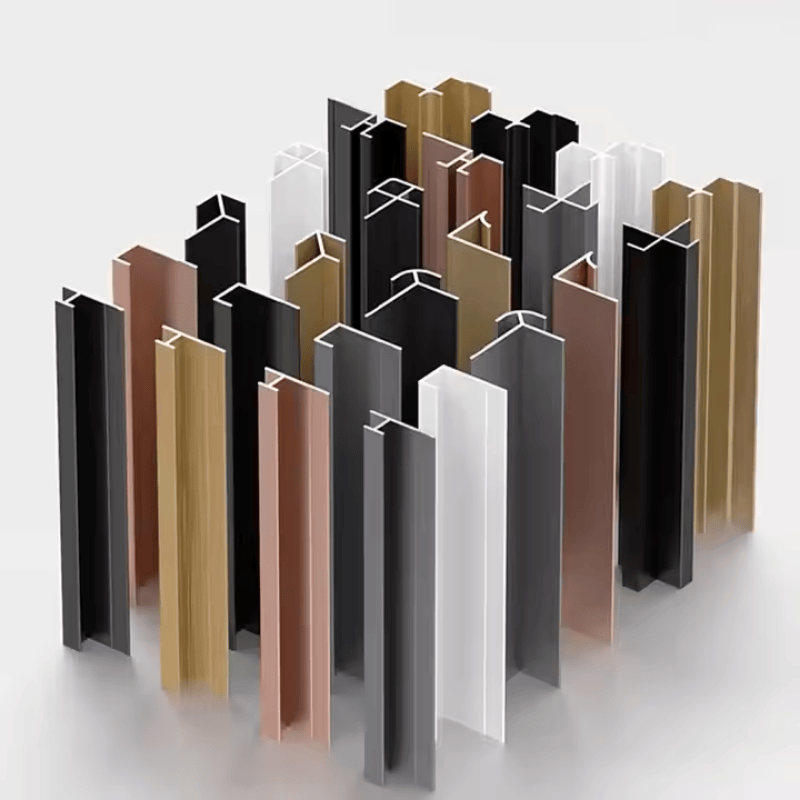

The aluminum market has always been a dynamic and vital part of the global economy, driven by continuous technological advancements and evolving market demands. In 2025, the Association of Southeast Asian Nations (ASEAN) is poised to witness significant expansion in its aluminum market. This growth is fueled by various factors, including rapid urbanization, booming construction projects, and the increasing adoption of aluminum in high - tech industries. Aluminum, with its unique properties such as lightweight, corrosion resistance, and high strength - to - weight ratio, has found its way into numerous applications across different sectors in ASEAN. From traditional construction uses like aluminum casement windows to high - tech applications such as aluminum extruded profiles for heatsinks, the aluminum market in ASEAN is on an upward trajectory. This blog post will delve into the various aspects of ASEAN's aluminum market expansion in 2025, exploring the market trends, technological advancements, and the key applications that are driving this growth.

1. The Current State of the ASEAN Aluminum Market

Before looking at the expansion prospects in 2025, it is essential to understand the current state of the ASEAN aluminum market. ASEAN countries have been steadily increasing their production and consumption of aluminum in recent years. The region has a diverse industrial base, with countries like Indonesia, Malaysia, and Thailand being major players in aluminum production. The construction sector has been the primary driver of aluminum demand, with aluminum being widely used in building structures, windows, and doors. For instance, aluminum casement windows have become increasingly popular due to their durability, low maintenance, and aesthetic appeal.

In addition to construction, the automotive industry in ASEAN has also been showing a growing appetite for aluminum. As automakers strive to meet stricter fuel - efficiency standards, the use of lightweight aluminum components is on the rise. This includes aluminum profiles for body frames, trims, and engine components. The electronics industry is another significant consumer, especially for aluminum extruded profiles for heatsinks, which are crucial for dissipating heat in electronic devices.

2. Driving Forces Behind the 2025 Expansion

Urbanization and Infrastructure Development

One of the most significant driving forces behind the ASEAN aluminum market expansion in 2025 is the rapid urbanization and large - scale infrastructure development projects across the region. Cities are expanding, and there is a growing need for new residential and commercial buildings. Aluminum is an ideal material for construction due to its lightweight nature, which reduces the overall weight of the building structure and makes construction more efficient. In the case of aluminum casement windows, they are not only energy - efficient but also add a modern look to buildings.

Infrastructure projects such as airports, bridges, and high - speed rail systems also require large amounts of aluminum. Aluminum profiles are used for structural supports, railings, and interior fittings, offering a combination of strength and durability.

Technological Advancements in Aluminum Extrusion

The advancements in aluminum extrusion technology are playing a crucial role in the market expansion. Aluminum extrusion is the process of pushing heated aluminum through a die to create profiles with specific cross - sectional shapes. In 2025, new extrusion techniques are allowing for the production of more complex and precise profiles. This has opened up new opportunities for using aluminum in industries that require high - precision components, such as aerospace and electronics.

For example, the production of aluminum extruded profiles for heatsinks has become more efficient and cost - effective. The improved extrusion technology enables manufacturers to create profiles with better heat - dissipation properties, meeting the increasing demands of the electronics industry for high - performance cooling solutions.

Growing Industrialization and Manufacturing

ASEAN is experiencing a wave of industrialization, with countries focusing on developing their manufacturing capabilities. The industrial machinery and equipment sector is expanding, and aluminum profiles are being used extensively in the construction of machinery frames, conveyor systems, and workstations. Modular aluminum profiles, such as T - slot profiles, are popular due to their ease of assembly and disassembly, allowing for flexible and customizable manufacturing setups.

The aluminum kitchen section is also emerging as a significant application area. As consumers in ASEAN are becoming more conscious of kitchen design and functionality, aluminum is being used for cabinets, countertops, and storage systems. Its corrosion - resistant and easy - to - clean properties make it an attractive choice for kitchen applications.

3. Key Applications of Aluminum in 2025

Construction Sector

In 2025, the construction sector in ASEAN will continue to be a major consumer of aluminum. The use of aluminum in curtain walls is expected to increase as architects and developers seek to create modern and energy - efficient buildings. Aluminum casement windows will also see further growth, with a focus on improving insulation and security features.

In addition, aluminum will be used more extensively in roofing systems and structural supports. The development of new alloys and surface finishes will enhance the performance of aluminum in construction applications, making it more resistant to corrosion and weathering.

Automotive Industry

The automotive industry in ASEAN is likely to witness a significant increase in the use of aluminum. With the push towards electric vehicles (EVs), aluminum is becoming even more crucial due to its lightweight nature, which helps to increase the range of EVs. Aluminum profiles will be used for creating lightweight yet strong body frames, reducing the overall weight of the vehicle and improving fuel efficiency.

Automotive trims and exterior components will also be predominantly made of aluminum, offering a combination of durability and aesthetic appeal. The development of new manufacturing techniques will enable automakers to produce more complex aluminum parts with higher precision.

Electronics Industry

The electronics industry in ASEAN is set to drive a large portion of the aluminum demand in 2025. The increasing miniaturization of electronic devices requires efficient heat - dissipation solutions, and aluminum extruded profiles for heatsinks are the go - to option. As the demand for smartphones, laptops, and other consumer electronics continues to grow, so will the need for high - quality aluminum heatsinks.

In addition, aluminum is being used in the manufacturing of electronic enclosures and frames. Its electromagnetic shielding properties make it an ideal material for protecting sensitive electronic components from external interference.

Kitchen and Interior Design

The aluminum kitchen section is emerging as a niche but growing market in ASEAN. In 2025, more consumers are expected to opt for aluminum - based kitchen solutions due to their durability, modern look, and easy maintenance. Aluminum cabinets, countertops, and storage units are becoming popular choices for both residential and commercial kitchens.

Interior designers are also incorporating aluminum into various interior design elements, such as room dividers, handrails, and decorative fixtures. The versatility of aluminum allows for creative and functional design solutions.

4. Technological Innovations in Aluminum Production

Advanced Alloys Development

In 2025, there is a significant focus on developing advanced aluminum alloys in ASEAN. These new alloys are designed to have improved properties such as higher strength, better corrosion resistance, and enhanced thermal conductivity. For example, alloys specifically formulated for use in aerospace and automotive applications are being developed to meet the stringent requirements of these industries.

The development of new alloys also has implications for the electronics industry. Alloys with improved thermal conductivity are ideal for aluminum extruded profiles for heatsinks, allowing for more efficient heat dissipation.

Precision Extrusion Technologies

The extrusion process has seen remarkable technological advancements. New precision extrusion technologies are enabling manufacturers to produce aluminum profiles with extremely tight tolerances. This is crucial for applications that require high - precision components, such as in the aerospace and medical device industries.

These technologies also allow for the production of more complex cross - sectional shapes, expanding the design possibilities for aluminum products. For instance, in the production of aluminum casement windows, precision extrusion can create profiles with integrated insulation channels, improving the energy efficiency of the windows.

Sustainable Production Practices

As environmental concerns become more prominent, there is a growing emphasis on sustainable production practices in the aluminum industry. In 2025, ASEAN aluminum manufacturers are adopting technologies to reduce energy consumption, water usage, and waste generation during the production process.

Recycling of aluminum is also gaining momentum. The closed - loop recycling systems are being implemented, where used aluminum products are collected, recycled, and turned into new aluminum profiles. This not only reduces the environmental impact but also helps in conserving natural resources.

5. Market Challenges and Solutions

Raw Material Supply and Price Volatility

One of the major challenges faced by the ASEAN aluminum market is the volatility in raw material prices. The price of bauxite, the primary raw material for aluminum production, can fluctuate significantly due to global market conditions, geopolitical factors, and supply - demand imbalances.

To address this challenge, some aluminum manufacturers in ASEAN are exploring alternative raw material sources and entering into long - term supply contracts. Additionally, there is a push towards increasing the recycling rate of aluminum, which can reduce the dependence on virgin raw materials.

Competition from Other Materials

Aluminum also faces competition from other materials in various applications. For example, in the construction sector, PVC and wood - plastic composites are competing with aluminum for window and door applications. In the automotive industry, carbon fiber and high - strength steel are also vying for market share.

To stay competitive, aluminum manufacturers need to focus on highlighting the unique properties of aluminum, such as its lightweight nature, corrosion resistance, and recyclability. They also need to invest in research and development to improve the performance of aluminum products and reduce production costs.

Regulatory and Quality Standards

Meeting regulatory and quality standards is another challenge for the ASEAN aluminum market. Different countries in the region may have varying standards for aluminum products, especially in terms of safety, environmental impact, and performance.

To overcome this, industry associations in ASEAN are working towards harmonizing the regulatory and quality standards across the region. Manufacturers are also investing in quality control systems to ensure that their products meet or exceed the required standards.

6. Regional Market Analysis within ASEAN

Indonesia

Indonesia has a rich bauxite reserve, making it a key player in the aluminum production chain. In 2025, the country is expected to expand its aluminum smelting and extrusion capacity. The growing construction and automotive industries in Indonesia are driving the demand for aluminum products, especially aluminum casement windows and automotive components.

Malaysia

Malaysia has a well - developed manufacturing base, and the aluminum industry is an important part of it. The country is focusing on high - value - added aluminum products, such as precision - extruded profiles for electronics and aerospace applications. The government's support for research and development in the aluminum sector is expected to further boost the industry's growth.

Thailand

Thailand is a major automotive manufacturing hub in ASEAN. The automotive industry in Thailand is driving the demand for aluminum profiles for vehicle frames, trims, and engine components. In addition, the construction sector in Thailand is also contributing to the aluminum market growth, with an increasing preference for aluminum in building structures and interior design.

Other ASEAN Countries

Other ASEAN countries such as Vietnam, the Philippines, and Singapore are also showing growth in their aluminum markets. Vietnam is rapidly industrializing, and the construction and manufacturing sectors are fueling the demand for aluminum. The Philippines is seeing an increase in infrastructure projects, which is driving the need for aluminum profiles. Singapore, with its focus on high - tech industries, is a significant consumer of aluminum extruded profiles for electronics applications.

7. Future Outlook Beyond 2025

Looking beyond 2025, the ASEAN aluminum market is expected to continue its growth trajectory. The increasing adoption of sustainable development goals across the region will further drive the demand for aluminum, given its recyclability and energy - efficient production processes.

The development of new technologies, such as 3D printing of aluminum components, is likely to open up new application areas. 3D printing can enable the production of complex aluminum parts with reduced waste and lead times. This technology could revolutionize the manufacturing of aluminum products in industries like aerospace, automotive, and medical.

The growing middle - class population in ASEAN will also lead to increased consumption of consumer goods, which will in turn drive the demand for aluminum in packaging, electronics, and household appliances.

8. Collaboration and Partnerships in the ASEAN Aluminum Industry

In 2025, collaboration and partnerships are becoming increasingly important in the ASEAN aluminum industry. Manufacturers are partnering with research institutions to develop new alloys and production technologies. For example, collaborations between aluminum producers and universities can lead to the discovery of innovative extrusion techniques or the development of more sustainable production processes.

There are also partnerships between different players in the value chain. Aluminum producers are teaming up with fabricators and end - users to ensure that the products meet the specific requirements of the market. This collaborative approach helps in streamlining the production process, reducing costs, and improving the overall quality of aluminum products.

Conclusion

In conclusion, the ASEAN aluminum market in 2025 is set for significant expansion, driven by a combination of urbanization, technological advancements, and growing industrialization. The diverse applications of aluminum, from construction and automotive to electronics and kitchen design, are fueling the demand for various aluminum products, including aluminum casement windows, aluminum extruded profiles for heatsinks, and aluminum kitchen sections.

The industry is also witnessing remarkable technological innovations in alloy development, precision extrusion, and sustainable production practices. However, it also faces challenges such as raw material price volatility, competition from other materials, and regulatory differences. Through collaboration, innovation, and strategic planning, the ASEAN aluminum industry is well - positioned to overcome these challenges and continue its growth trajectory.

As we look to the future, the potential for further growth in the ASEAN aluminum market is immense, with new technologies and emerging applications on the horizon.

Here is a question for all aluminum enthusiasts and industry professionals: With the increasing use of aluminum in high - tech applications, how can we ensure that the recycling process of complex aluminum - based electronic components is efficient and environmentally friendly?

If you have any technical inquiries or need assistance related to aluminum products, feel free to contact us. We are here to provide you with professional advice and solutions.

En

En

Location:

Location: